The Home Equity Acceleration Plan Book

Pay Off your Mortgage Early

Millions of people write out their mortgage check dreaming of the day it will be paid off. Unfortunately, for most, that day is often 20+ years down the road.

In an effort to pay off a mortgage early people send a few extra dollars to the lenders and some even use a “bi-weekly” payment plan. Neither are overly effective and will only take a few years off the mortgage term.

Is there a better way? Absolutely. It’s called the Home Equity Acceleration Plan (H.E.A.P.™).

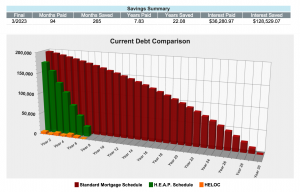

H.E.A.P.™ is a plan that can be setup with NO COST and NO RISK. Look at the following chart. The green bars represent someone paying off their home loan in 11-years using H.E.A.P.™ and the maroon bars represent paying off the mortgage in 30-years. WHICH ONE LOOKS BETTER TO YOU?

Look at the following real world example for a typical American couple: Mr. Smith and Mrs. Smith earn $3,000 collectively twice per month as their take-home pay (after-tax pay which equates to $72,000 after-tax in a dual-income household). Assume they have a $250,000 house with a $200,000 mortgage balance. Assume the interest rate on the loan is 6.25% with a payment of $1,231 a month (without taxes and insurance). Assume the loan has 30 years remaining. Further, assume that their monthly bills (not including the mortgage) are $3,500 a month.

How long would it take the Smiths to pay off their mortgage using H.E.A.P.? 8.75 YEARS!

How much would the Smiths save in interest expenses over the life of the loan using H.E.A.P.? $184,442!

View the book online or download to your favorite device

If you are ready to learn how you can pay off your home mortgage years earlier with a plan that has NO COST and NO RISK, click the button “Get My FREE Books Now.”

GET MY FREE BOOKS NOW